Have you ever wanted to go to a country far away or day dream about going back to a favorite place? As you’re sitting in front of your computer, you can do a little virtual travel while directly benefiting that place you’re thinking about. Sound good? We think so, let us tell you how. This post was sparked by an email I received this morning from Kiva. The email was sent announcing that a loan Meggan and I gave was paid in full. I’m sure many of you know what Kiva is all about, but if you don’t, it’s a micro finance organization that connects lenders like us to entrepreneurs around the world. “Kiva’s mission is to connect people, through lending, for the sake of alleviating poverty.” In a nut shell, Kiva is not about handouts, they are about helping people around the world help themselves.

This post was sparked by an email I received this morning from Kiva. The email was sent announcing that a loan Meggan and I gave was paid in full. I’m sure many of you know what Kiva is all about, but if you don’t, it’s a micro finance organization that connects lenders like us to entrepreneurs around the world. “Kiva’s mission is to connect people, through lending, for the sake of alleviating poverty.” In a nut shell, Kiva is not about handouts, they are about helping people around the world help themselves. The way it works is you set up your own Kiva account that can be funded with Pay Pal or a credit card. You click on the lend button and it will take you to a listing of all the entrepreneurs requesting business loans. In this case, these loans are micro-loans, theses entrepreneurs require very little money (in our standards) to fund their business venture. This may be a little sum of money, but it’s a crucial amount to grow their business. Once you make the loan, Kiva keeps you up to date on the progress of the business you are loaning to and also the repayment schedule.

The way it works is you set up your own Kiva account that can be funded with Pay Pal or a credit card. You click on the lend button and it will take you to a listing of all the entrepreneurs requesting business loans. In this case, these loans are micro-loans, theses entrepreneurs require very little money (in our standards) to fund their business venture. This may be a little sum of money, but it’s a crucial amount to grow their business. Once you make the loan, Kiva keeps you up to date on the progress of the business you are loaning to and also the repayment schedule. A $25 dollar loan directly attributes to growing an economy within a community. This amazes me. This morning at the grocery store I spent nearly $25 on a pack of roasted coffee beans, a carton of orange juice, and a box of doggy bones, which I can be certain didn’t have the same impact on our economy as it would in places like Uganda or Cambodia. I’m not saying you can’t have your morning coffee, orange juice or give your dog a bone, but it just puts things into perspective. If the low sum of money doesn’t make this organization approachable enough, than the repayment percentage should. As of today, Kiva has 98.79% repayment to it’s lenders. An astonishing number compared to our banking crisis in the US.

A $25 dollar loan directly attributes to growing an economy within a community. This amazes me. This morning at the grocery store I spent nearly $25 on a pack of roasted coffee beans, a carton of orange juice, and a box of doggy bones, which I can be certain didn’t have the same impact on our economy as it would in places like Uganda or Cambodia. I’m not saying you can’t have your morning coffee, orange juice or give your dog a bone, but it just puts things into perspective. If the low sum of money doesn’t make this organization approachable enough, than the repayment percentage should. As of today, Kiva has 98.79% repayment to it’s lenders. An astonishing number compared to our banking crisis in the US. How does this relate to travel? This is my favorite part. I love looking through the loans page, to me it’s like traveling. Exploring the unknown and learning about lifestyles other than your own. This isn’t like touristy places, this is like the parts of travel I really miss the most. Walking through a village, checking out the local market, or watching life go by through a bus window.

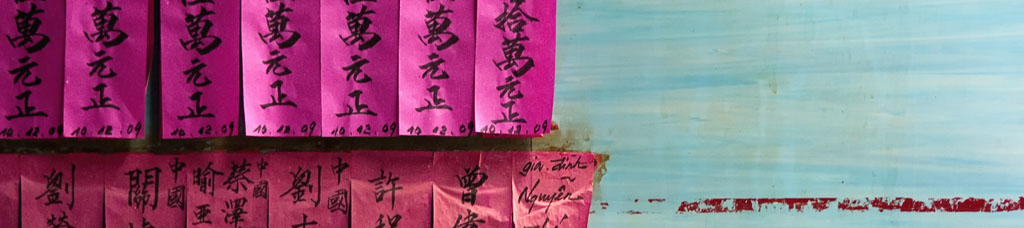

How does this relate to travel? This is my favorite part. I love looking through the loans page, to me it’s like traveling. Exploring the unknown and learning about lifestyles other than your own. This isn’t like touristy places, this is like the parts of travel I really miss the most. Walking through a village, checking out the local market, or watching life go by through a bus window. Meggan and my strategy is to loan to an entrepreneur to every country we have visited. As the loans get repaid, we put that money directly towards more loans to more people. We are trying to slowly build up our total loan amount and keep it rolling through entrepreneurs around the world. Your strategy can be based on places you’ve been, places you want to go, people’s profiles you find interesting, people’s businesses you find interesting, or however you would like. Just to give you some ideas you could loan to these entrepreneurs right now:

Meggan and my strategy is to loan to an entrepreneur to every country we have visited. As the loans get repaid, we put that money directly towards more loans to more people. We are trying to slowly build up our total loan amount and keep it rolling through entrepreneurs around the world. Your strategy can be based on places you’ve been, places you want to go, people’s profiles you find interesting, people’s businesses you find interesting, or however you would like. Just to give you some ideas you could loan to these entrepreneurs right now:

- Mrs. Ana Isabel B. C. a woman from Estado De Mexico, Mexico with a flower business [more info]

- Nancy from Peru who farms potatos [more info]

- A construction worker in Phnom Penh City, Cambodia [more info]

- Byamukama Silvester, a small general store owner in Mityana, Uganda [more info]

- A group of dress makers in Los Alcarrizos, Dominican Republic [more info]

- Altanzul Bataa a food stall owner in Ulaanbaatar, Mongolia [more info]

These are just scratching the surface, take your time and look around, it’s really interesting. As I was writing the list above, I had to delete some because they were already funded in full, when I checked again. There is about 1 loan going through Kiva every 19 seconds, come and join the thousands of people traveling through lending. If you have any questions or would like us to send you an invite to Kiva via email let us know at info@theworldeffect.com. Update: We just formed a Kiva team, we would love it if you would join, to do so go to this link.

These are just scratching the surface, take your time and look around, it’s really interesting. As I was writing the list above, I had to delete some because they were already funded in full, when I checked again. There is about 1 loan going through Kiva every 19 seconds, come and join the thousands of people traveling through lending. If you have any questions or would like us to send you an invite to Kiva via email let us know at info@theworldeffect.com. Update: We just formed a Kiva team, we would love it if you would join, to do so go to this link.